What is

Term Life Insurance?

It’s really the only type of insurance that will allow working families to buy enough to cover their needs. While everyone’s needs will vary by family and even over time, a good rule of thumb is that you’ll need five to 10 times your annual income.

Sarah W.

⭐⭐⭐⭐⭐

I never realized how important life insurance was until I had everything explained to me in a way I could easily understand. The policy was tailored to fit my family’s needs and budget. Now, I feel confident that my loved ones are protected no matter what. Thank you for giving us peace of mind!

Happy Customers

More than clients taken care of!

What is

Life Insurance?

Life insurance is a contract that provides financial protection for your loved ones in the event of your death. It offers options like Term Life (coverage for a set period) and Whole Life (lifetime coverage with savings). Get the right policy today to ensure your family’s financial security.

Why Choose Us?

Your family deserves financial security, and we make it easier than ever to get the protection they need.

Convenient Appointments

Whether you prefer a video conference call or an in-person meeting, we will meet with you on your terms.

Innovated Technology

Our innovative technology provides flexibility and a seamless experience from start to finish.

Simplified Solutions

Getting the right life insurance coverage for your needs doesn’t have to be complicated. Primerica’s simplified processes and term life insurance solutions are accessible and easy to understand.

Coverage You Can Afford

We will be there every step of the way to help ensure your family gets the coverage you need at a price that fits your budget.

Start today and give your loved ones the peace of mind they deserve, knowing they’re covered when it matters most.

How It Works

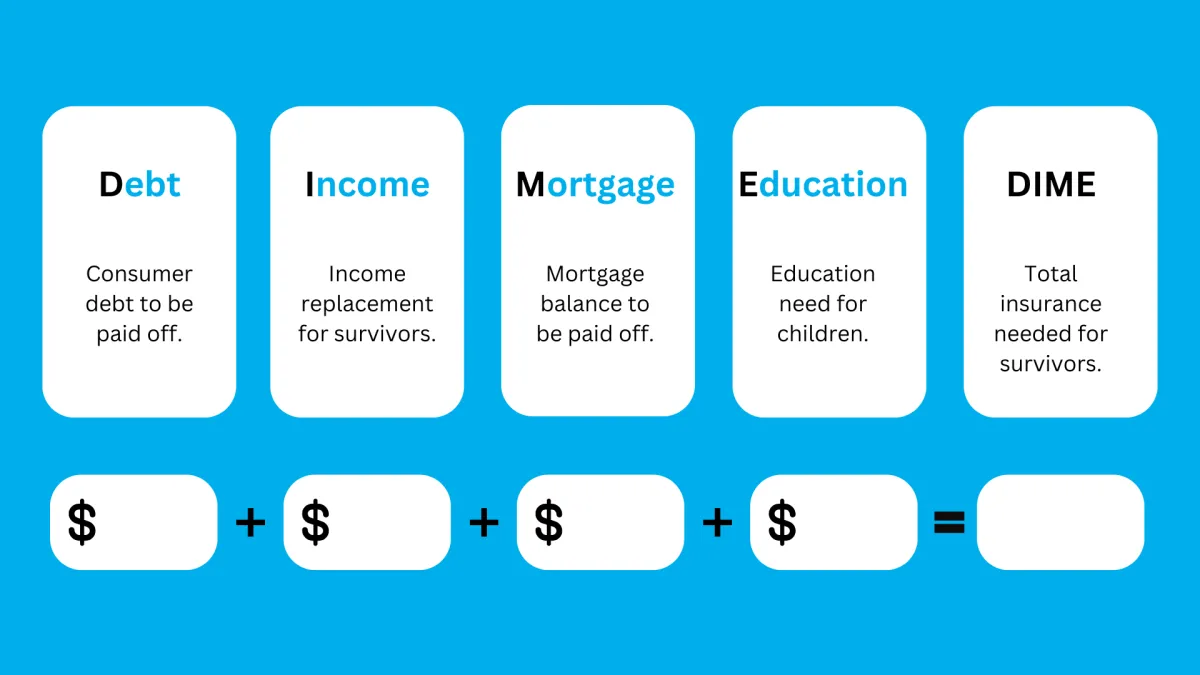

The DIME Method is an easy way to figure out how much coverage your family would need in order to maintain your current quality of life and keep the financial goals you intend to fund with that lifetime of income alive.

Why Do You Need Life Insurance?

If anyone depends on your income or if you have obligations (debt, mortgage, etc.) that would fall to someone else to handle if you were to die, then the answer is likely, “Yes.”

Think about it this way:

If you calculate how much you’ll earn in a lifetime, it likely would add up to a “fortune.” The potential risk of losing that earning power – earnings you’re counting on to fund your family’s biggest goals like buying a home, paying for your kids’ education, reducing debt, saving for retirement, etc. – especially at the early or mid-point of those years, is what makes life insurance important for most people.

Debt Coverage

Life insurance can help cover your outstanding debts like mortgages, car loans, credit card balances, and student loans.

Income Replacement

In case of your untimely demise, life insurance acts as a source of income, supporting your loved ones until they can get back on their feet.

Education Funding

Life insurance ensures that your children’s education goals can be met, no matter what happens.

Protect Your Family’s Financial Security

If you're the primary earner in your household, life insurance ensures that your family won’t be burdened with financial instability after your passing.

Funeral and End-of-Life Expenses

Funerals can be costly. Life insurance can ease the burden of these expenses on your family during an already difficult time.

More Info

Important Questions

Do I Really Need Life Insurance?

If anyone depends on your income or if you have obligations (debt, mortgage, etc.) that would fall to someone else to handle if you were to die, then the answer is likely, “Yes.”

What Is the “Right” Kind of Life Insurance?

Not all term life insurance is created equal. When comparing the life insurance that is right for you and your family, it's important to pay attention to policy specifics - and to the company that is offering them. Our affordable term life insurance products are packed with features designed to help give your family the right protection for your needs and budget.

How Much Life Insurance Do I Need?

If you’re like most families, the answer to that question is likely “more than you have.” Remember that “fortune” you’ll earn over a lifetime of income? The DIME Method is an easy way to figure out how much coverage your family would need in order to maintain your current quality of life and keep the financial goals you intend to fund with that lifetime of income alive.

How do I Sign Up?

For more personalized assistance, book an appointment with me. I’ll answer your questions, help you explore your options, and ensure you get the right life insurance coverage tailored to your specific needs. Schedule your free consultation today and start planning for your family’s future security.

Why Choose Us?

Your family deserves financial security, and we make it easier than ever to get the protection they need.

Flexible Coverage Options

Find the perfect plan for your needs and budget.

Quick, Hassle-Free Process

Get approved in minutes, with no medical exams for most plans.

Affordable Premiums

Protect your family without breaking the bank.

Start today and give your loved ones the peace of mind they deserve, knowing they’re covered when it matters most.

How It Works

Life is unpredictable, but your financial future doesn’t have to be. We’re here to help you protect the ones who matter most.

1. Get a Quote

Tell us a little about yourself, and we’ll find the best coverage.

2. Choose Your Plan

Select a policy that fits your budget and needs.

3. Rest Easy

Enjoy the confidence that your family is financially secure.

With a few simple steps, you can ensure peace of mind for you and your loved ones, knowing that they’ll be taken care of, no matter what.

Why Do You

Need Life Insurance?

Life insurance provides financial security for your family when you're no longer around to provide for them. Here are some reasons to consider getting life insurance:

Debt Coverage

Life insurance can help cover your outstanding debts like mortgages, car loans, credit card balances, and student loans.

Income Replacement

In case of your untimely demise, life insurance acts as a source of income, supporting your loved ones until they can get back on their feet.

Education Funding

Life insurance ensures that your children’s education goals can be met, no matter what happens.

Protect Your Family’s Financial Security

If you're the primary earner in your household, life insurance ensures that your family won’t be burdened with financial instability after your passing.

Funeral and End-of-Life Expenses

Funerals can be costly. Life insurance can ease the burden of these expenses on your family during an already difficult time.

More Info

Important Questions

What Type of Life Insurance Do I Need?

If you are looking for affordable coverage for a specific period, Term Life Insurance may be best. For lifelong protection and cash value accumulation, Whole Life Insurance could be the right choice.

How Much Coverage Should I Get?

Consider factors like your family’s living expenses, outstanding debts (like mortgages), future financial goals, and potential funeral costs when determining the amount of coverage you need.

Can I Customize My Life Insurance Policy?

Yes, many policies offer additional riders for things like accelerated death benefits, critical illness coverage, or waiver of premium in case of disability. These options allow you to customize the policy to meet your specific needs.

What If I Can’t Afford Life Insurance Right Now?

There are budget-friendly options like Term Life Insurance with lower premiums. You can also adjust coverage amounts and durations to find a plan that fits within your financial means.

How do I Sign Up?

For more personalized assistance, book an appointment with me. I’ll answer your questions, help you explore your options, and ensure you get the right life insurance coverage tailored to your specific needs. Schedule your free consultation today and start planning for your family’s future security.

Looking for a First-Class Life Insurance Consultant?

Looking for a First-Class Life Insurance Consultant?

Legacy Movement Connection is committed to serving you at the highest level with all your Life Insurance needs.

National Producer Number: 7363600

Company

Directories

Legal

Legacy Movement Connection is committed to serving you at the highest level with all your Life Insurance needs.

National Producer Number: 7363600

Company

Directories

Legal